The Value of a Penny

Lessons learned from reading my Great-Grandparent’s financial ledger they kept during The Great Depression.

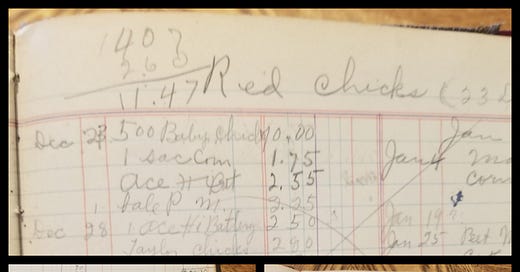

My Great-Grandma Waelbrock died in 1992 at the age of 94. Her husband, Grandpa John, passed in 1969. Among all of the treasures of their life together I have discovered, one of the most interesting is a financial ledger they kept during 1931-1938. Grandpa John was a professional carpenter, Grandma Waelbrock a stay-at-home mom with an entrepreneurial spirit any Girl Boss today would be proud of. (Yes, I am a believer in preposition stranding – too bad!)

The record shows that John Waelbrock was a successful and popular house-builder. Grandma Waelbrock ran a chicken and egg empire. The ledger details purchases of 500 and 600 baby chicks on a monthly basis. She was selling eggs, obviously, but also chicken manure for fertilizer, and many other commodities, i.e. butter, milk, straw, feed. It is not clear, but it appears she was buying some of these commodities in bulk, and then reselling them at a slim profit.

A recurring entry is for the sale of “Red Fryers”, in quantities of a single bird to over 50 birds to one customer in one transaction. The sale price: 21 cents a bird. Roosters appear to have been sold or traded to other chicken farmers for breeding purposes, a smart animal husbandry rule to widen the gene pool and create healthier animals.

The ledger shows she extended credit accounts for many customers and neighbors alike. She was continually active in the Catholic Church and the Knights of Columbus, and there are recurring entries of sales of eggs and whole birds to the Dominican Sisters of San Gabriel, the local convent. Grandma and Grandpa’s children attended the Catholic School at the San Gabriel Mission. One note details the yearly cost of tuition ($10) and music lessons ($11.36) for both kids being deducted from the balance due for eggs and chickens.

The ledger also holds the financial records of Grandpa John’s carpenter business. It appears he employed several of his relatives, paying wages of 50 cents per hour. Cousin Mike was getting paid for cement work, with weekly pay ranging from $13.75 to a high of $36.25 ($646.90 in 2020 dollars) for one week alone. Grandpa John’s son Theophile was making anywhere from 5.95 a week to a high of $16.80. Fred St. Pierre, another cousin or uncle was making equivalent wages. John was providing jobs, good paying jobs, at a critical time for these men and their families.

In 1938 alone, he built six houses. One transaction shows the full contract price for the “Barton job” was $2800.00. His expenses were $2507.42. His net profit on that job alone was $292.58, which is over $5200 in today’s dollars. Six of those in one year alone seems remarkably successful for the time. The average annual income in 1938 was $1731. It appears Grandpa and Grandma Waelbrock found a way to prosper, and spread that prosperity around, during the Depression.

Grandpa John seems to have been a visionary of sorts. One section of the ledger details “Second Hand Lumber”. It looks like he was salvaging his own job sites and selling the scraps to increase profits and reduce disposal costs. And in the process, foreshadowing todays great concern of reducing and recycling waste. Brilliant!

Grandma’s poultry profits were adding up as well. For instance, in 1932, the second years of the ledger, the net yearly profit for all poultry related concerns was $193.31. That amount turns into $3449.70 in 2020 dollars. By 1935, she was clearing $325 (2020 $$ = $5800) in annual profit.

One of the coolest entries is titled “Bowling Account”. It appears that they were trading eggs for their favorite recreational past-time – bowling. The entry states: Oct 19 – 1 doz eggs .35. The standard price per game was 20 cents. So they trade a dozen eggs, and basically get to bowl two games for free!

What this tells me about them, and about myself during this almost year-long pandemic is educational and inspiring. The Waelbrock’s arrived in America in 1923, emigrating from Winnipeg, Canada. The family lore tells of three brothers marrying three sisters, and setting off to find the American dream with $400 in cash split among the three young families.

Grandma and Grandpa created a value proposition, and acted as equal partners in a time when women were not considered equal. They both worked extremely hard and long hours, and were rewarded for that work ethic. They supported family, church and community, and in turn, were supported back. They recycled waste into commodities and turned salvage into surplus. They were frugal, and utilized an extensive network and the barter system to acquire luxuries and leisure activities. They found a way to insure their children received a top-notch education, including extra-curricular activities.

Most importantly, and I believe the single most important lesson to found in this ledger is this:

They created multiple income streams, and kept perfect accounting of EVERY SINGLE PENNY.

That is the purpose of my writing, and the beginning of what I hope to become: a 2020 version of the industrious 1930’s Waelbrock’s. The elements for success are in my blood. Hard work. Responsibility. Accountability. Creativity. Tenacity.

Thank you Grandma Waelbrock and Grandpa John. Your memories and legacies live on.

Great article!! Let's not forget the diligent saving of tin and foil!! ;))